Who Else Wants Tips About How To Avoid Deficiency Judgement

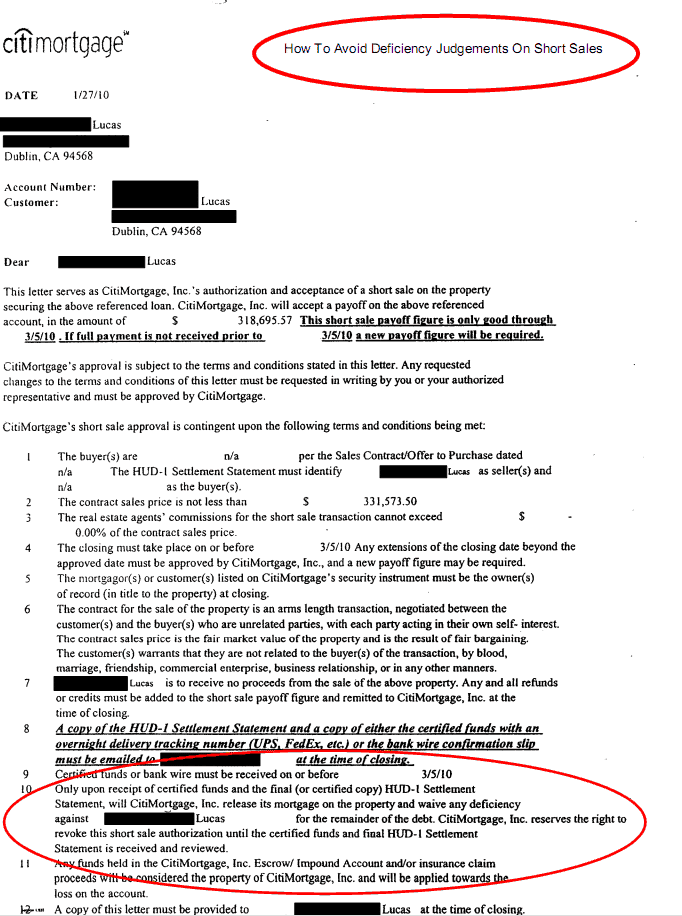

How to avoid a deficiency judgment.

How to avoid deficiency judgement. If you file for bankruptcy, you might be able to avoid paying what. Alternative options like a short sale can also help you avoid deficiency judgments. Learn what a deficiency judgment is, and learn how to avoid.

I have about $500,000 liquid and about $225,000 in a retirement account. Wage garnishment occurs when an employer takes a portion of each of a borrower’s paychecks and sends it to the lender. If the lender can sue, then you have to wonder if they will sue.

A short sale is agreed. Florida laws allow the lender a year to sue for a deficiency judgement. Five tips on how to avoid foreclosure and keep your home.

Another way to avoid deficiency is to apply for the home affordable foreclosure alternatives (hafa) program. Even after a foreclosure, you can still get a call from your mortgage lender claiming that you owe them even more money. There are strategic ways to avoid this type of judgment.

If you're liable to pay the deficiency after a. Find out what is and is not allowed. If you are facing foreclosure in florida , your best bet to avoid a deficiency judgment is with a short sale.

How a deficiency judgment works. Each state’s laws vary on how and when a lender can seek a deficiency judgment. Posted on november 18, 2018 in commercial real estate, foreclosures, mortgages, real estate, residential real estate

Filing for bankruptcy to discharge a deficiency judgment. Trying to pursue a short sale is often the best option for many faced with a foreclosure. If you lender agrees to use this program you will be released.

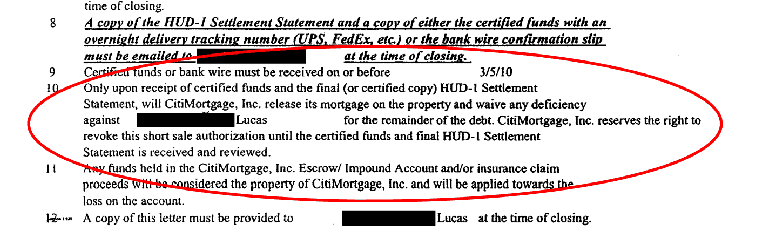

With a short sale, your lawyer can negotiate a deficiency judgment waiver. Lenders don’t always act on a deficiency judgment. A 'deficiency' state or a 'recourse' state is a state where the laws allow a mortgage lender to retain the right to pursue a homeowner after a foreclosure for a deficiency judgment.

Up to 25% cash back how can i avoid a deficiency judgment following a short sale? The worst thing you can do is ignore foreclosure issues. I lost my job and took one in a neighboring state at half the pay.

Deficiency judgments can be a homeowner's worst nightmare after already experiencing the nightmare of foreclosure. A good way to avoid a deficiency judgment is through a negotiated short sale. If they think the amount owed is too little, they might not act.