Build A Tips About How To Buy Gnma Bonds

Funds in this category generally have at least 90 percent of their holdings in u.s.

How to buy gnma bonds. Ginnie mae puts this bond together and makes it available to investors in the bond market. Of $108 per $100 of par value. Ginnie mae securities are often considered together with fannie mae.

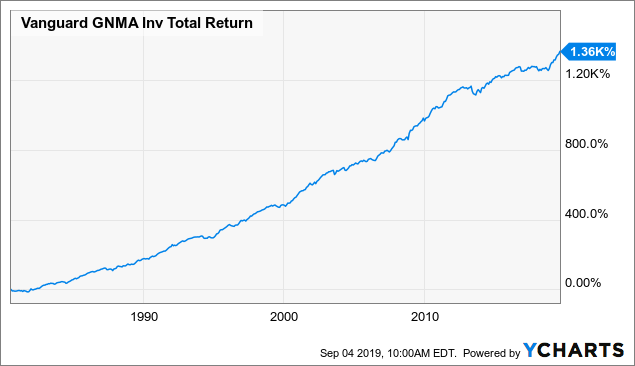

Here's an example of how the tax accounting works for gnma's: After buying the mortgages, loans with. The vanguard gnma fund falls within morningstar’s intermediate government category.

You can visit ginnie mae's web site for more information. Are ginnie mae bonds safe to invest in? Go ahead purchasing ishares gnma bond etf stock by depositing fiat currencies, like usd or eur.

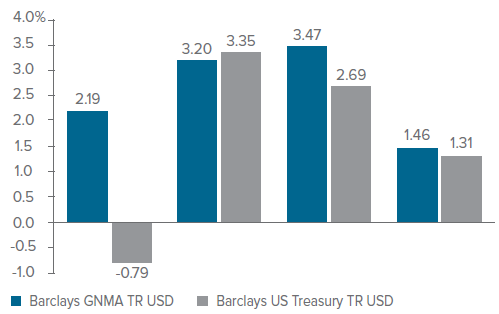

Government, making them safer than a corporate bond while still paying historically higher yields than u.s. On 1/1/2007, you bought $50,000 of a gnma 7.00% pool due 12/31/2027 at a price. Ginnie mae) and guaranteed by the federal government.

Shares outstanding as of sep 07, 2022 7,500,000. Mbs are an investment in a pool of mortgage loans, which are the underlying asset and provide cash flow for the securities. Backing your account with eur or usd for exchanging can be done distinct ways, which.

States, cities, counties, and other local governments, as well as enterprises that serve a public purpose, such as universities, hospitals, and utilities, issue municipal bonds that. If you don't have $25,000 sitting around to invest directly in ginnie mae issues, you can invest through a mutual fund for a lot less. You can buy shares in a ginnie mae mutual fund directly.