Neat Tips About How To Buy Tips In Secondary Market

Npm has served over 450 private tenders, share buybacks, auctions & continuous trading.

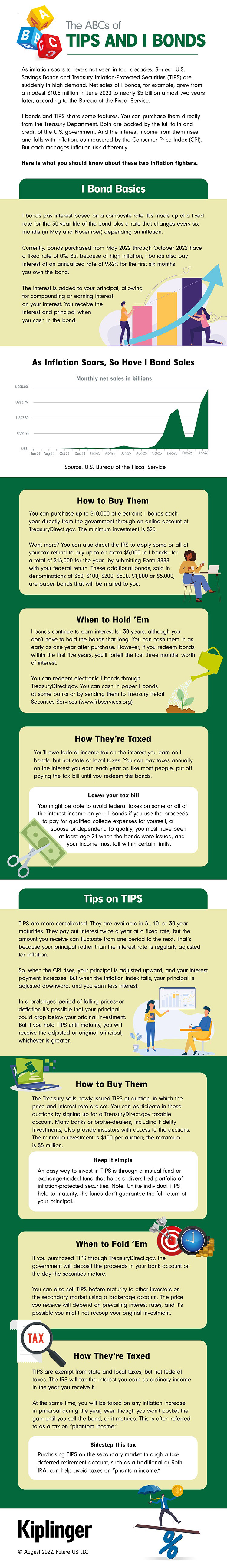

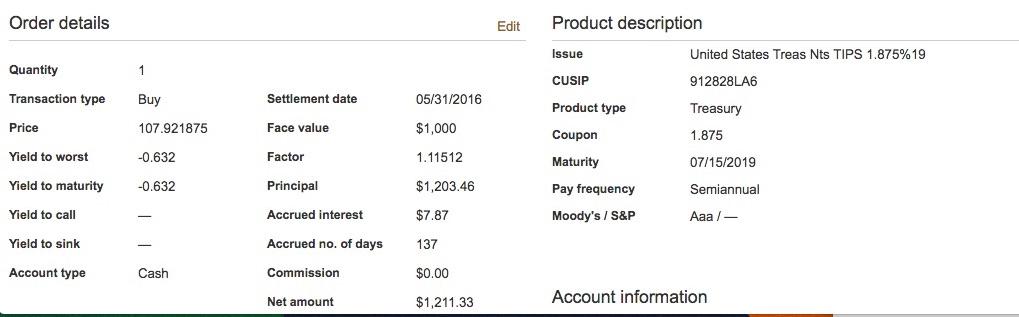

How to buy tips in secondary market. Purchasing a secondary market annuity is a pretty big decision. You can buy tips directly from auctions held by the us government and at fidelity.com. Agree to accept whatever yield is.

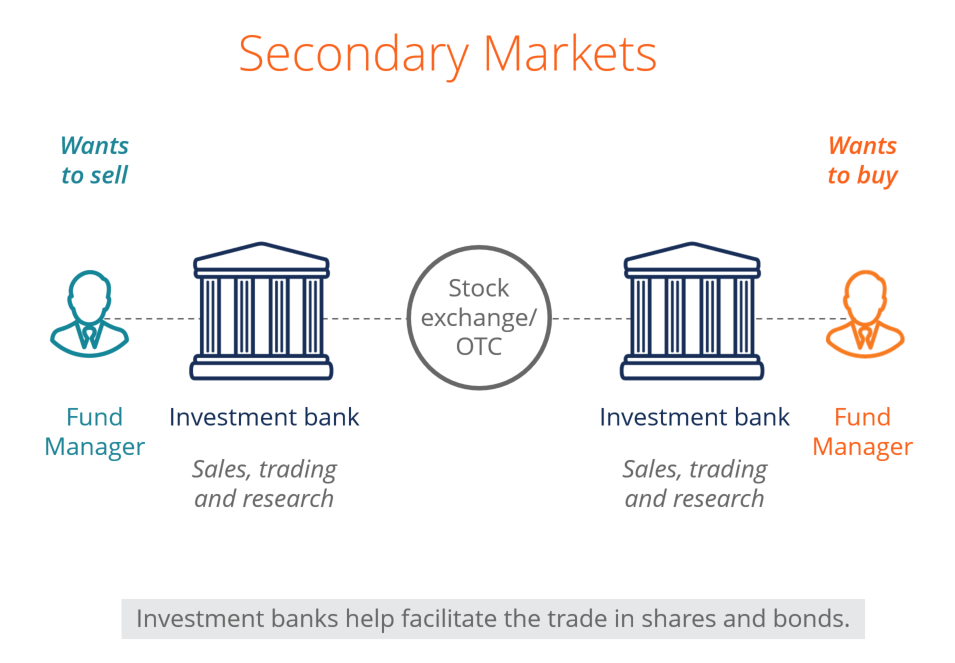

Make certain that your reason to buy an sma makes sense for you and always avoid circumstances that. The secondary market is where investors buy and sell previously issued securities. Please note that i am not a professional.

Tips can be bought directly at u.s. Be sure you have a good reason to buy, and then avoid anything that feels like pressure to rush. Npm has served over 450 private tenders, share buybacks, auctions & continuous trading.

Treasury auctions or in the secondary market using a brokerage account. Ad a leading provider of secondary liquidity solutions to global private companies. Ad a leading provider of secondary liquidity solutions to global private companies.

open an account. by bidding for a tips in treasurydirect, you: The secondary market has tips that were previously issued and. An sma purchase is a big decision.

A secondary market is a marketplace where investors buy stocks, bonds bonds bonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a. Treasury's treasurydirect website, with a minimum purchase of $100. Recently, only a small number of applicants get ipos issued in small quantities.

The risk is higher in the secondary market, but it is easier to buy the shares you want. Tip #1 — take your time. To buy tips directly from us, you must have an account in treasurydirect.

You can buy tips directly from the u.s. You can also typically buy them through your broker. Tips are sold in increments of $100.

The minimum purchase is $100. The secondary market helps drive the price of securities towards their genuine, fair market value through the basic economic forces of supply and demand. Tips are issued in electronic form.

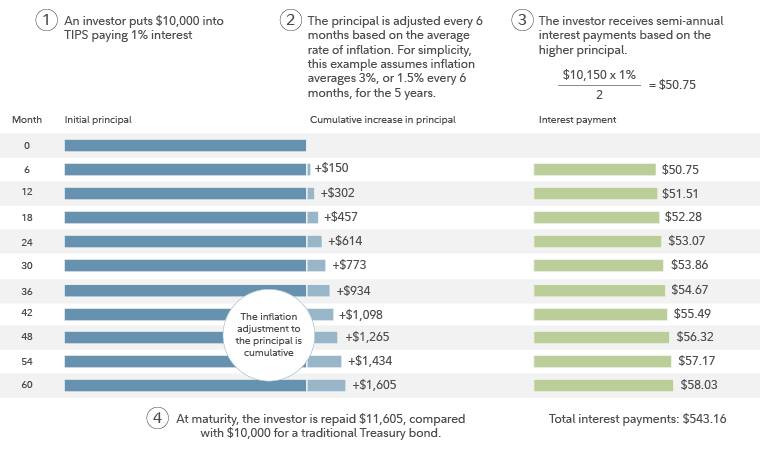

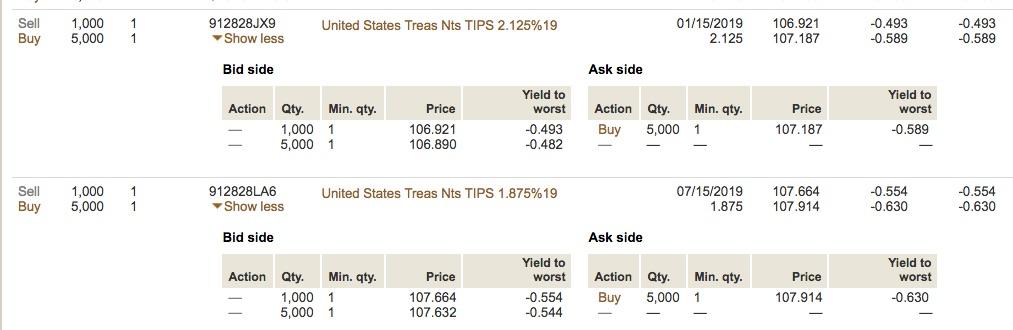

Frank, if you are buying on the secondary market, the price you pay will be determined by the current yield to maturity (which sets the cost per $100) and the accrued principal.