Top Notch Tips About How To Lower Credit Card Debit

We make it easy to get your funds in as little as 24 hours.

How to lower credit card debit. Say you owe $2,000 on a credit card with a 20% apr and a $40 monthly minimum payment. How to avoid credit card debt. Seek help (if you need it) 7.

Pay more than the minimum. If you have a few credit cards, there is an effective debt reduction plan to follow. Ad consolidate $20,000 or more.

Americor will find the best solution for you. Ad learn more about our debt resolution program today. You can ask if they’ll allow you to apply points to pay off your balance faster.

You should immediately shop for a new credit card that offers a lower rate, experts say. How to attack credit card debt. Pay off the card with the highest interest rate first.

Afcc & bbb a+ accredited. Avoid bankruptcy and revive your credit! No upfront fees & no obligation.

Higher rewards — ask for more points or more flexible rewards. A key tip on how to lower credit card debt is to reduce the number of credit cards you have. Ad get instantly matched with the ideal credit card debt consolidation for you.

Reduce the number of credit cards you own. Our certified debt counselors help you achieve financial freedom. Of the new debt that accumulated during that quarter, $46 billion was credit card debt.

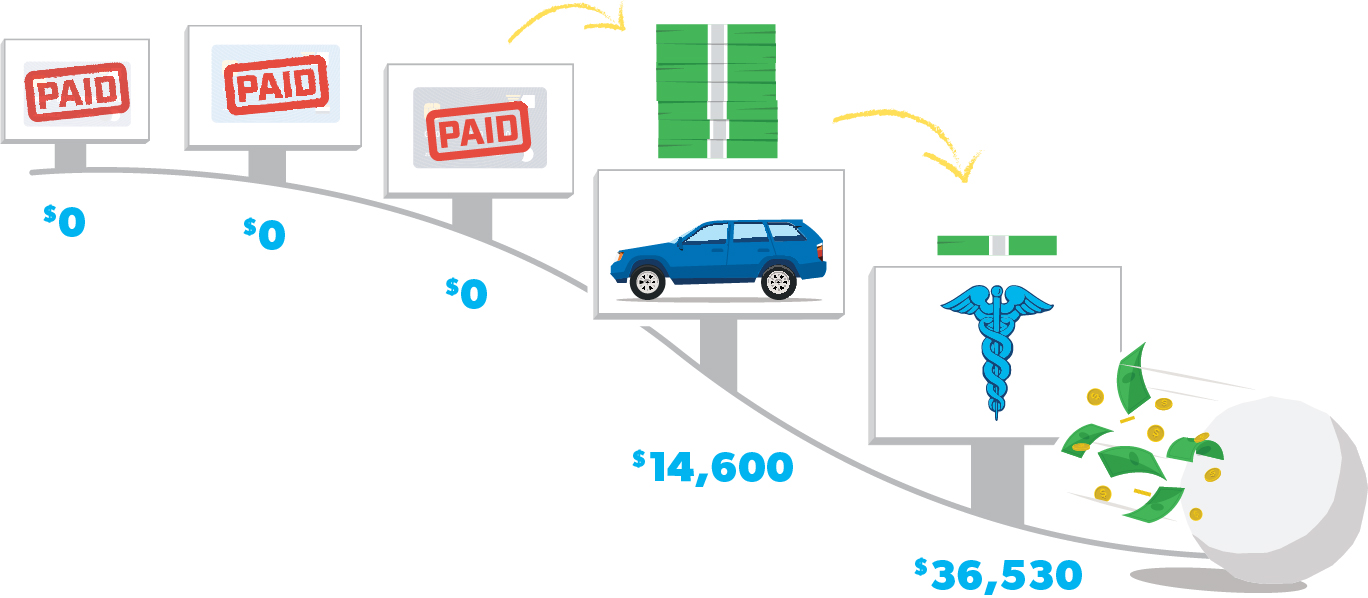

As you work to get rid of your credit card debt, it's also important to take steps to avoid taking on more of it in the future. Transfer balances to zero percent card. One simple way to make a huge impact is to pay double the minimum.

Borrowers with lower income, worse credit adding debt A 0% balance transfer credit card may be your best weapon in the battle against credit. Often a simple phone call to the issuer is all it takes to get a reduced rate—provided that you have good credit (a score of 730 or.

Work on your financial habits. Ad consolidate debt & borrow up to $50k with fixed aprs. Americor will find the best solution for you.

_1.jpg?ext=.jpg)

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

/dotdash-050415-what-are-differences-between-debit-cards-and-credit-cards-Final-2c91bad1ac3d43b58f4d2cc98ed3e74f.jpg)