Heartwarming Tips About How To Reduce Share Capital

Cancelling share capital no longer supported by the.

How to reduce share capital. How to make a capital reduction? A share capital reduction can be achieved by a variety of methods: How can you reduce your company’s share capital?

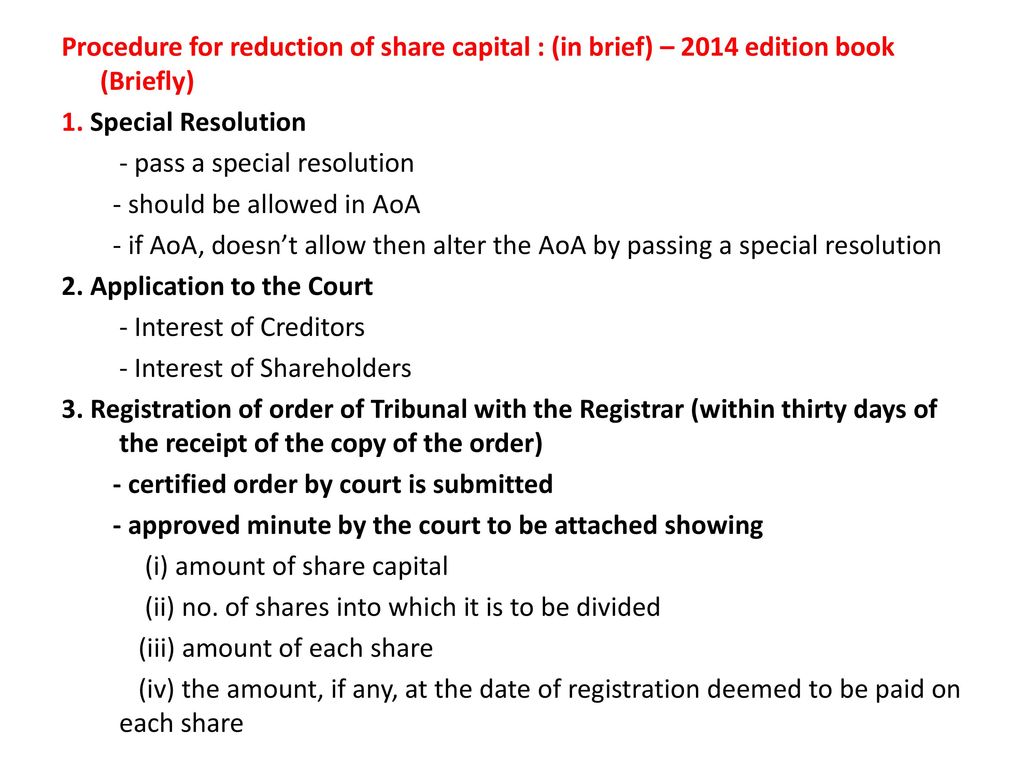

First, a notice must be sent out to creditors of the resolution of the capital reduction. You need to put in place a compromise of arrangement whereby the share capital of the company is reorganised formally with a court orderyou can reduce the share premium. (b) filing an order of court.

Nowadays, it’s possible to reduce share capital prior to striking off. You can also use this form. You can reduce share capital to a minimum of 1 issued share and the usual practice for share capital reductions is for them to be pro rata across all members.

Pass a special resolution supported by a solvency statement (section 117). There are two ways in which a limited company can reduce share capital, by way of a court order or by issuing a solvency statement in which the directors declare that the company can pay its debts. Even if the special resolution is passed, the court must approve the.

A company may reduce its share capital by doing either of the following: It can cancel any shares which have. The date for the shareholder’s.

You must ensure that the any of the reasons. A public companymay only reduce its capital with court approval. Capital reduction is the process of decreasing a company’s shareholder equity through share cancellations and share repurchases, also known as share buybacks.

Members’ approval follow these steps if your. How a reduction of share capital can be structured. Methods to reduce share capital:

A company is required to reduce its share capital using a set of specific steps. Prepare a written special resolution outlining your intent to reduce your company’s share capital. Pass a special resolution and confirmation by the court (section 116) b.

Prior to 1 october 2008, reducing capital required a court approval. A company may want to reduce its share capital for various reasons, including to create distributable reserves to pay a dividend or to buy back or redeem its own. How to reduce the share capital of a company it can cancel the liability for shareholders to pay the unpaid capital on their shares.

There are 2 ways to reduce share capital for singapore companies: This form can be used as a statement of capital by a private limited company reducing its capital supported by a solvency statement. A reduction in share capital is useful if you want to reduce or cancel your company’s paid up shares or unpaid up shares.