Outstanding Info About How To Settle Debts

Be honest with yourself about how much you can pay each month.

How to settle debts. When you enter a debt settlement program to settle credit card debt or debt from personal loans, you’ll need to stop making monthly payments to. Compare & find best value for you. Get your free quote now!

If you send a debt validation request. Don’t bury your head in the sand when you first get a debt collection letter. To find yours, divide your debt payments by your income, and multiply by 100.

Ad get your financial house in order without bankruptcy or loan. The best way to deal with a collection agency is the debt validation method. To successfully negotiate a debt settlement plan, it is.

If you have more than $20k in credit card debt americor can help! Ad we have picked the top(5) back tax help companies out of 100's. We’ll provide tips and advice that will help you get back on track and start.

Take some time to research how much you owe on your credit card or cards. Things to do when settling debts. The most common method is to negotiate a settlement with the credit card company.

An attorney can help you negotiate terms with a debt collector and make a fair offer for settlement. You've likely seen and heard ads from companies claiming they can settle your debt with the irs for pennies on the dollar. they claim you need their services to strike a deal. In this blog post, we will discuss how to improve your credit score after debt settlement.

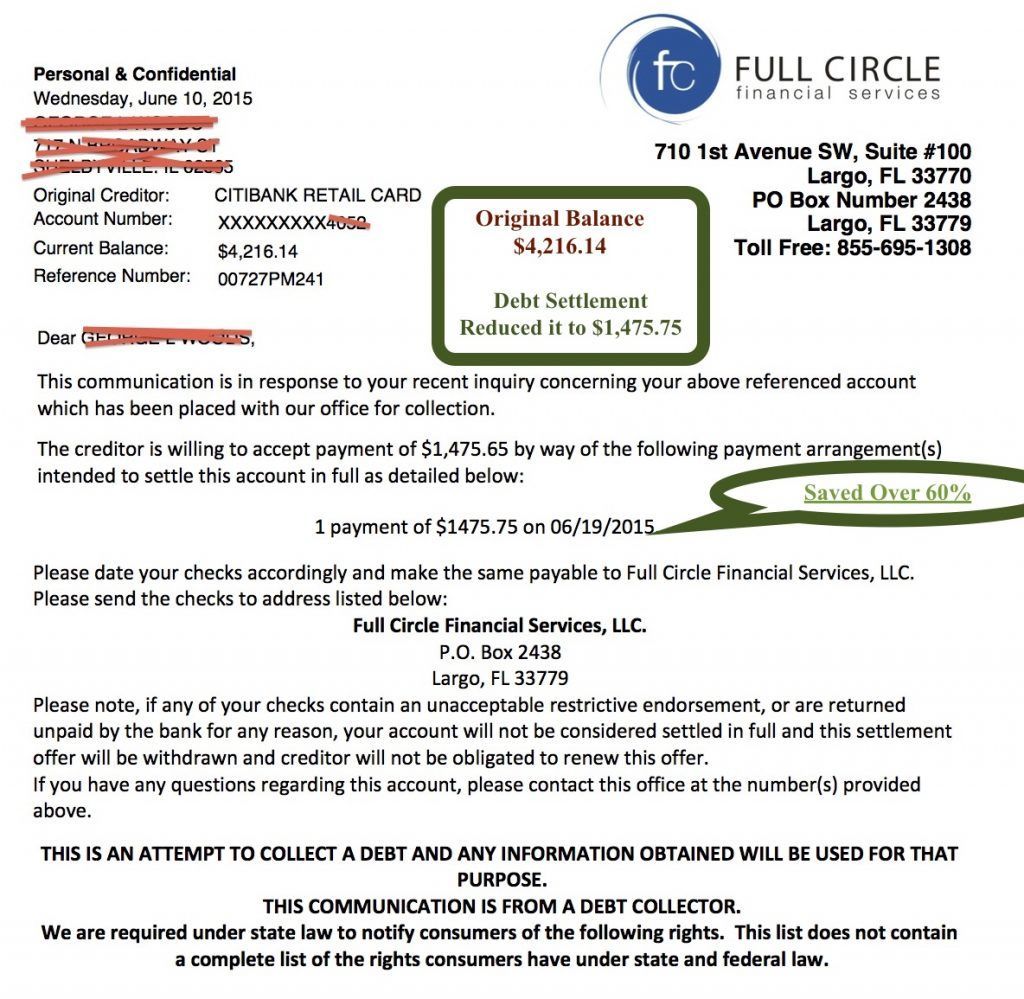

This means you agree to pay a certain amount of money in order to settle your debt. If you're experiencing financial hardship, discover's 60/60 plan can reduce your debt to 60% and allow you to pay it off over a course of. A consolidation loan can also be obtained through a home equity loan.

Here’s the problem with debt settlement: Read pros & cons today! Get a free debt consultation in minutes.

Get facts, & breakdowns of back tax help companies. If you want to make a proposal to repay this debt, here are some considerations: Jun 17, 2022 • 9 min read.

A debt settlement would lower the amount of debt outstanding. For example, $1,200 of monthly debt divided by $3,000 of monthly income is 0.4 x 100 = 40%. Where to start with credit card debt evaluate your debt.