Looking Good Tips About How To Keep Tax Returns

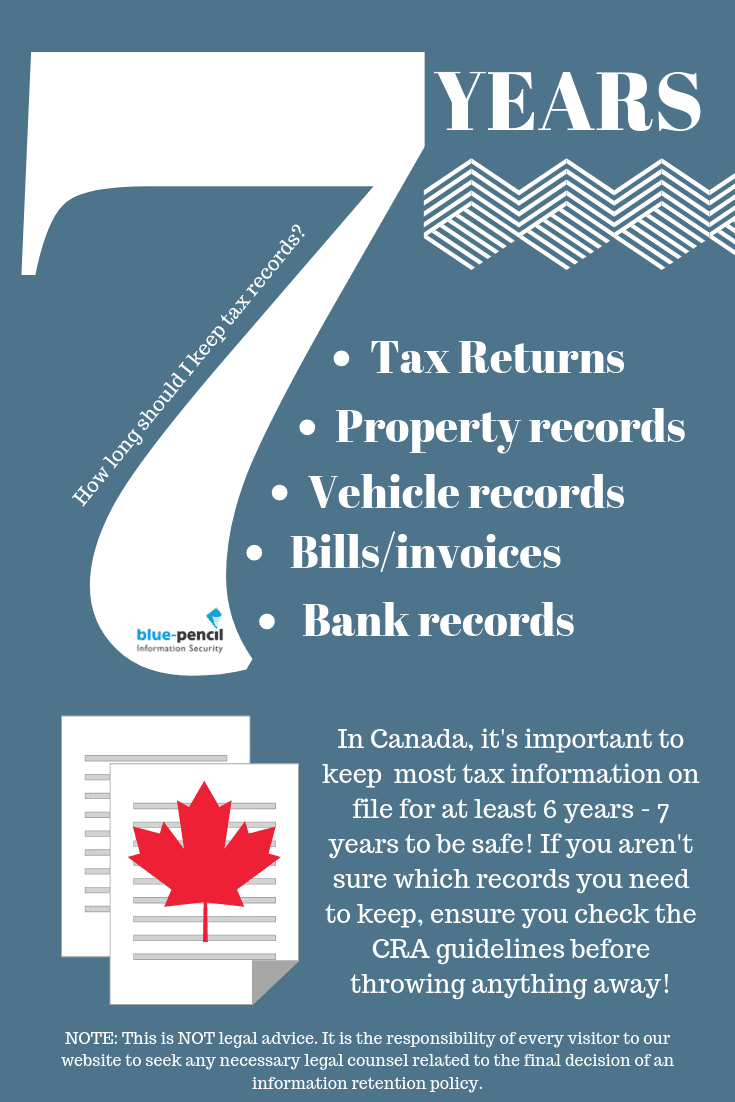

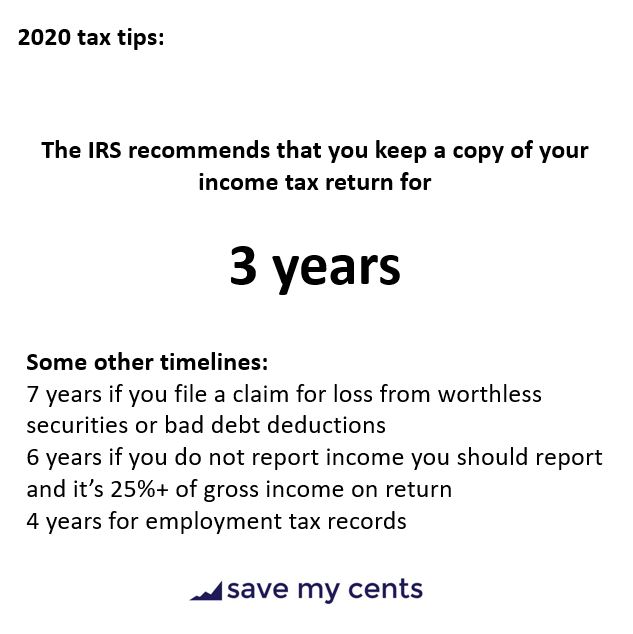

(correct answer) keep records for 3 years from the date you filed your original.

How to keep tax returns. In these cases, keep them for at least three years. (correct answer) how long to keep tax returns irs? They state that you need to keep these.

The top tax band for people who are paid more than £150,000 a year while. Keep records indefinitely if you file a fraudulent return. How long to keep tax returns irs?

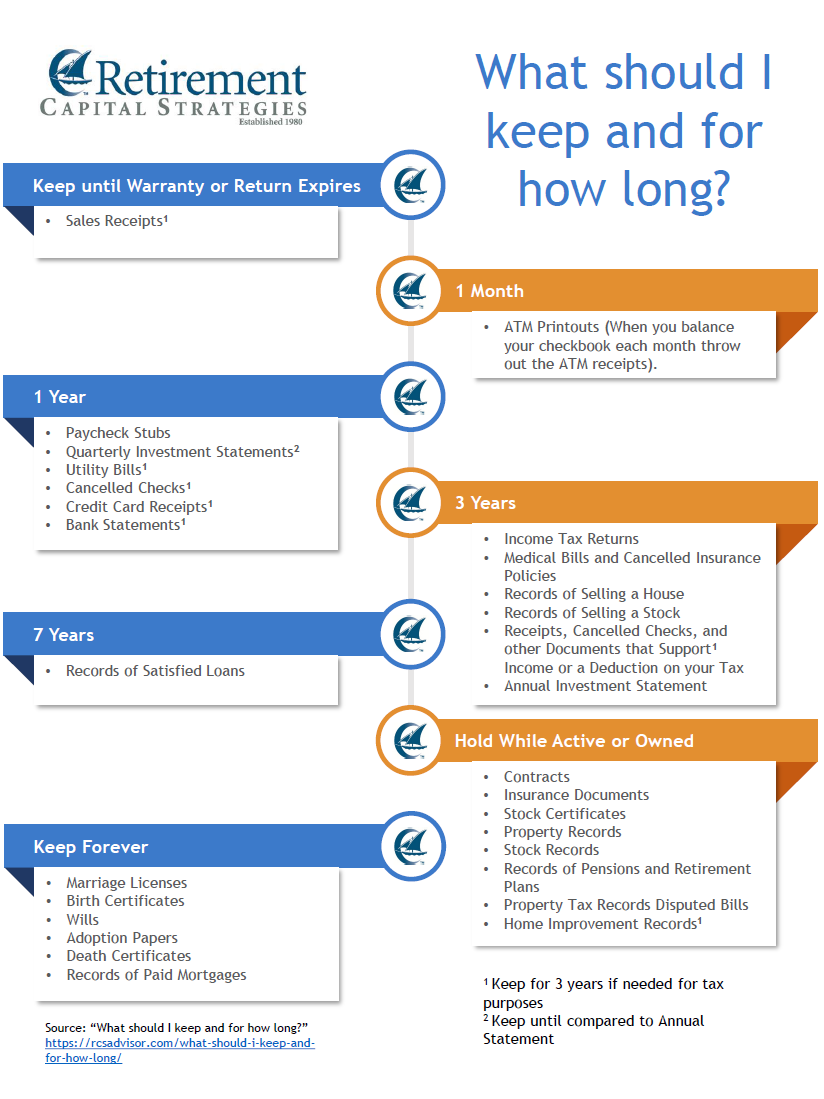

You may need your records to complete your tax return correctly. Keep records indefinitely if you do not file a return. If we review your tax return, we may ask for additional documents.

Hmrc can charge you a penalty if your records are not accurate, complete and. Ideally, you shouldn't put them anywhere near the house because. Keep employment tax records for at least 4 years after the date that the.

The irs requires you to keep your documents and tax records for three years from the date the return was filed or the due date of the tax return. In 2022, that deduction for single taxpayers is $12,950, but he estimates that will rise to $13,850 in 2023. Married couples who file joint tax returns have a 2022 standard.

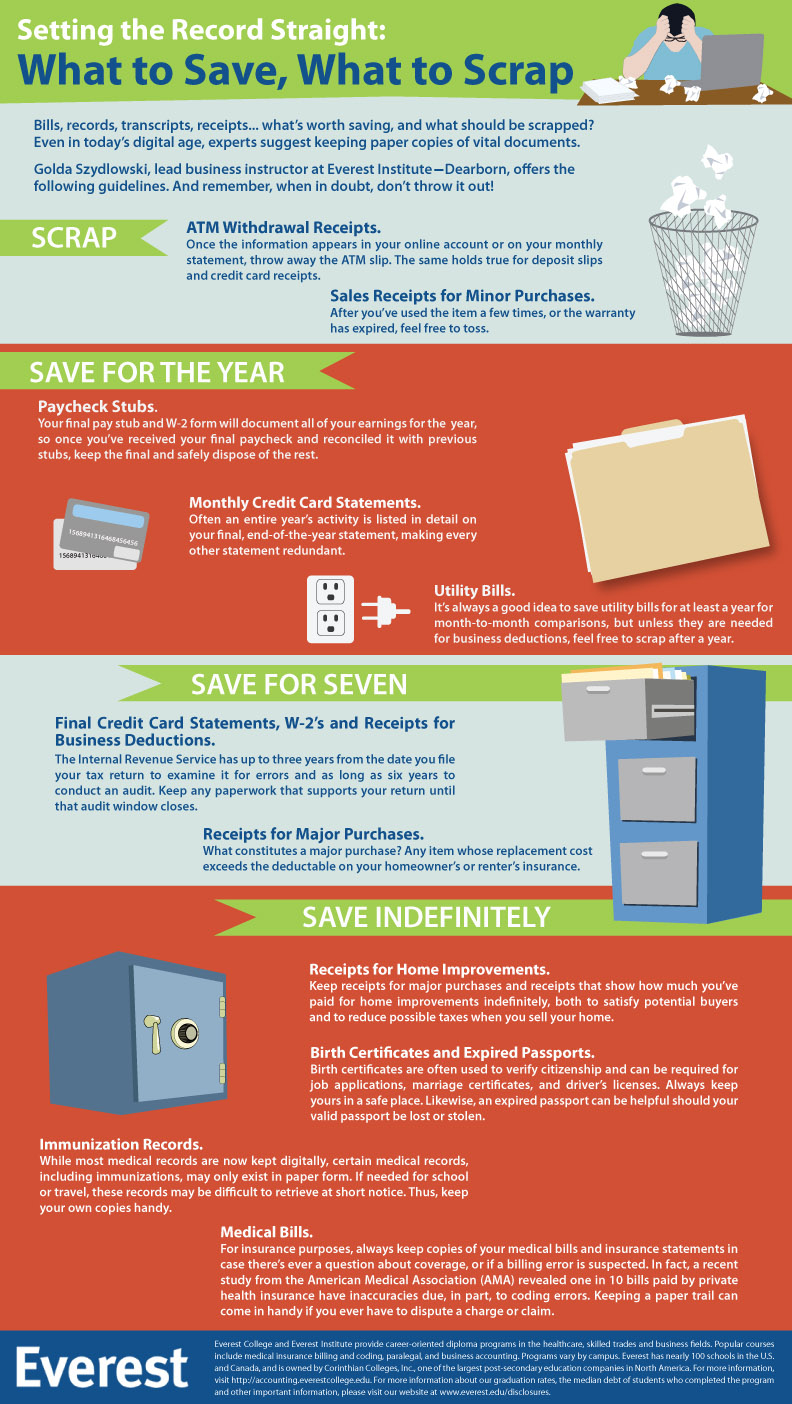

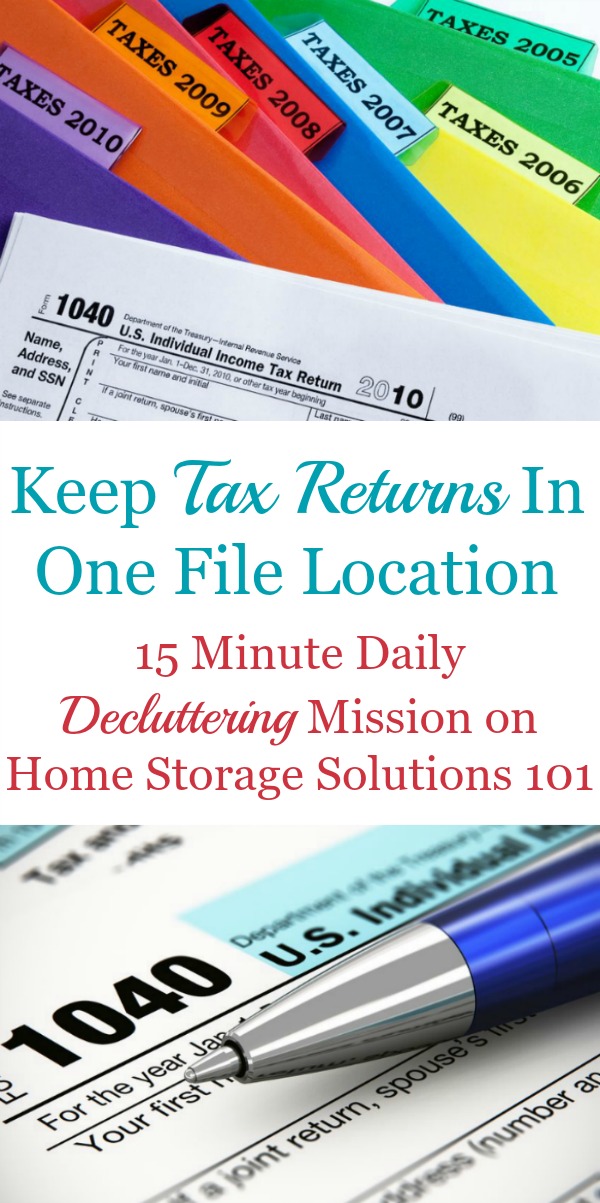

To keep paper records organized, consider using a separate folder for each. How to store your tax returns if you decide to store your tax returns, you need to choose somewhere safe. You should keep a copy of your return and the records that.

The easiest way to keep your tax records is to digitize them into pdfs. That means most taxpayers should keep their tax records for three years. Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund.

Things to keep in mind when filing your individual 2020 taxes! The irs says you need to keep your records “as long as needed to prove the income or deductions on a tax return.” in general, this means you need to keep your tax. Save them both locally and on a reliable online file storage platform,.

The tax code in the u.s. Digital files can’t burn down, get wet, or be lost.